Debt can be a heavy burden to bear, and for many individuals and families in Alberta, it can become overwhelming. When facing mounting debts, it’s crucial to explore various options to regain financial stability. Debt relief services offer a lifeline to those in need, providing guidance and assistance in managing and reducing debt. In this article, we’ll take a closer look at how a debt relief service works and how it can help you regain control of your financial future.

Debt can be a heavy burden to bear, and for many individuals and families in Alberta, it can become overwhelming. When facing mounting debts, it’s crucial to explore various options to regain financial stability. Debt relief services offer a lifeline to those in need, providing guidance and assistance in managing and reducing debt. In this article, we’ll take a closer look at how a debt relief service works and how it can help you regain control of your financial future.

Understanding Alberta Debt Relief Services

Alberta debt relief services are organizations that specialize in helping individuals and families address their financial challenges. These services provide expert guidance, support, and a range of debt management solutions designed to fit the unique circumstances of each client. Whether you’re facing credit card debt, medical bills, or other financial obligations, a debt relief service can be a valuable ally in your journey toward financial freedom.

Here’s a breakdown of how an Alberta debt relief service typically works:

- Initial Consultation:

The first step in the debt relief process is a consultation with a certified debt counsellor. During this initial meeting, you’ll discuss your financial situation, including your outstanding debts, income, and expenses. The debt counsellor will evaluate your circumstances and help you understand the available debt relief options.

- Customized Debt Relief Plan:

Based on the information gathered during the consultation, the debt relief service will create a customized plan tailored to your specific needs. This plan may include strategies like debt consolidation, debt settlement, budgeting, or bankruptcy, depending on your financial situation and goals.

- Debt Negotiation:

If debt settlement is deemed a suitable option, the debt relief service will negotiate with your creditors on your behalf. They will work to reduce the overall amount you owe and negotiate for more favourable terms, such as lower interest rates or extended payment schedules.

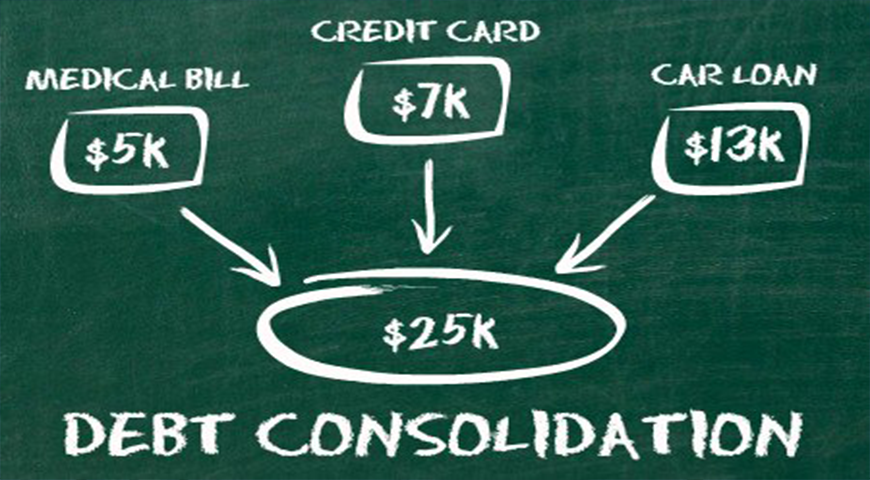

- Debt Consolidation:

For those with multiple debts, debt consolidation may be recommended. This involves taking out a new loan or credit product to pay off all existing debts, simplifying your payments and often offering more favourable terms.

- Budgeting and Financial Education:

A crucial aspect of Alberta debt relief services is educating clients about sound financial management practices. You’ll learn how to create a realistic budget, manage your expenses, and develop good financial habits to prevent future debt issues.

- Support and Monitoring:

Throughout the debt relief process, you’ll have access to ongoing support from your debt counsellor. They will monitor your progress and help you make any necessary adjustments to your debt management plan as your circumstances change.

- Debt Resolution:

Ultimately, the goal of an Alberta debt relief service is to help you resolve your debts and regain your financial independence. Once your customized plan is executed and your debts are addressed, you can enjoy the peace of mind that comes with a healthier financial future.

Debt relief services play a vital role in helping individuals and families navigate the often complex world of debt management. By offering personalized guidance, support, and a range of debt relief options, these services empower clients to take control of their financial well-being. If you find yourself overwhelmed by debt, don’t hesitate to reach out to a reputable Alberta debt relief service. With their assistance, you can embark on a path toward financial stability and a debt-free future.