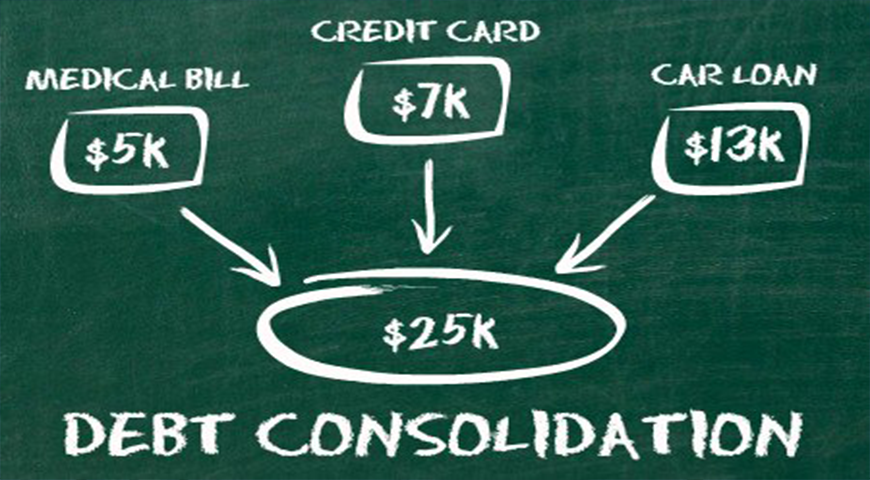

Managing debt can be a challenging task for many Canadians, but there are several options available to help consolidate debt and streamline your debts into more manageable payments. Debt consolidation is a strategy that allows individuals to combine multiple debts into a single loan or payment plan, making it easier to keep track of and pay off what you owe. In this article, we will explore some of the best ways to consolidate debt in Canada.

Managing debt can be a challenging task for many Canadians, but there are several options available to help consolidate debt and streamline your debts into more manageable payments. Debt consolidation is a strategy that allows individuals to combine multiple debts into a single loan or payment plan, making it easier to keep track of and pay off what you owe. In this article, we will explore some of the best ways to consolidate debt in Canada.

- Debt Consolidation Loan

A debt consolidation loan is a popular option for Canadians looking to streamline their debt. With this method, you borrow a lump sum of money from a financial institution, such as a bank or credit union, and use it to pay off your existing debts. This leaves you with one single monthly payment to manage, often at a lower interest rate than your previous debts. These loans can be either secured (backed by collateral, such as your home or car) or unsecured (without collateral), depending on your financial situation and credit score.

- Home Equity Line of Credit (HELOC)

If you are a homeowner and have built up equity in your property, a Home Equity Line of Credit (HELOC) can be an effective way to consolidate debt. A HELOC allows you to borrow against the equity in your home and use the funds to pay off high-interest debts. The advantage of a HELOC is that it typically offers lower interest rates than unsecured loans or credit cards. However, it’s important to be cautious with this option, as your home is used as collateral, and failure to repay could result in the loss of your property.

- Credit Counselling

Credit counselling agencies in Canada can help individuals create a debt management plan. These plans involve working with a credit counsellor to negotiate with creditors for lower interest rates and manageable monthly payments. While not a direct consolidation method, it can help individuals repay their debts more efficiently. Credit counselling is particularly beneficial for those struggling with unsecured debts, such as credit cards.

- Debt Consolidation through a Debt Management Program

A Debt Management Program (DMP) is offered by credit counselling agencies and is suitable for those with unsecured debts. In a DMP, your counsellor negotiates with your creditors to reduce interest rates and create a manageable payment plan. You make one monthly payment to the credit counselling agency, which disburses the funds to your creditors. This simplifies the repayment process and helps you become debt-free faster.

- Debt Consolidation with a Balance Transfer Credit Card

Balance transfer credit cards allow you to transfer high-interest credit card balances to a card with a lower or zero-percent introductory interest rate. This can be a cost-effective way to consolidate and pay down credit card debt, as long as you can pay off the balance within the promotional period. Be aware of transfer fees and the interest rate that may apply after the promotional period ends.

- Debt Consolidation Loans for Bad Credit

If you have a low credit score and are struggling to qualify for traditional debt consolidation loans, you may still have options. Some lenders specialize in providing debt consolidation loans to those with less-than-perfect credit. These loans often come with higher interest rates, so it’s essential to compare your options and terms carefully.

Consolidating debt is a strategic approach for Canadians seeking to regain control over their financial situation. By combining multiple debts into one, you can reduce your interest payments, simplify your monthly budget, and work towards becoming debt-free. The best method for debt consolidation will depend on your individual circumstances and financial goals. It is advisable to consult with a financial advisor or credit counsellor to determine the most suitable path for your unique situation.