Debt can be a heavy burden to bear, and for many individuals and families in Alberta, it can become overwhelming. When facing mounting debts, it’s crucial to explore various options to regain financial stability. Debt relief services offer a lifeline to those in need, providing guidance and assistance in managing and reducing debt. In this article, we’ll take a closer look at how a debt relief service works and how it can help you regain control of your financial future.

Debt can be a heavy burden to bear, and for many individuals and families in Alberta, it can become overwhelming. When facing mounting debts, it’s crucial to explore various options to regain financial stability. Debt relief services offer a lifeline to those in need, providing guidance and assistance in managing and reducing debt. In this article, we’ll take a closer look at how a debt relief service works and how it can help you regain control of your financial future.

Category: Money

Best Ways To Consolidate Canadian Debt

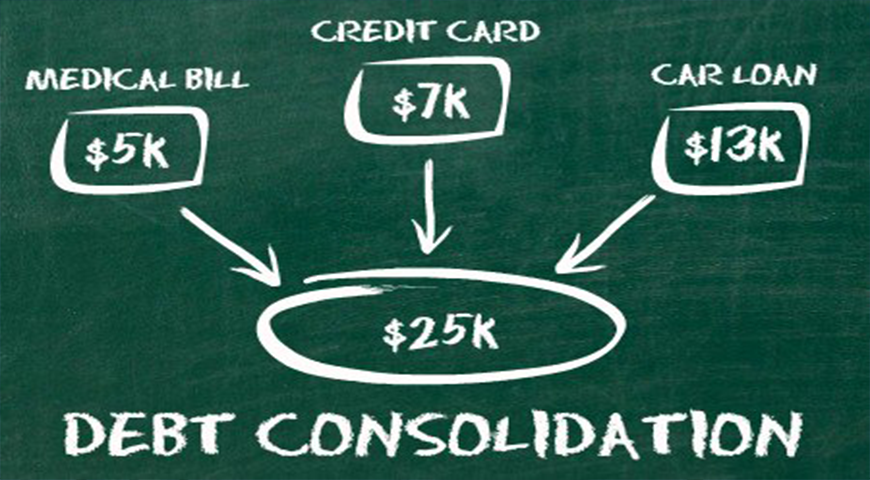

Managing debt can be a challenging task for many Canadians, but there are several options available to help consolidate debt and streamline your debts into more manageable payments. Debt consolidation is a strategy that allows individuals to combine multiple debts into a single loan or payment plan, making it easier to keep track of and pay off what you owe. In this article, we will explore some of the best ways to consolidate debt in Canada.

Managing debt can be a challenging task for many Canadians, but there are several options available to help consolidate debt and streamline your debts into more manageable payments. Debt consolidation is a strategy that allows individuals to combine multiple debts into a single loan or payment plan, making it easier to keep track of and pay off what you owe. In this article, we will explore some of the best ways to consolidate debt in Canada.

Using Debt Management For Financial Freedom

Learning debt management is an essential element of making the cash work of yours for you. An excellent place in order to begin on the road of yours to Financial Freedom is actually learning debt management as well as to start you’ve to learn the big difference in between bad debt and good debt. First allow me to provide you with a lot of definitions:

Learning debt management is an essential element of making the cash work of yours for you. An excellent place in order to begin on the road of yours to Financial Freedom is actually learning debt management as well as to start you’ve to learn the big difference in between bad debt and good debt. First allow me to provide you with a lot of definitions:

Debt that is good: Any debt in which the price of the debt is going to be surpassed by the earnings are actually created by whatever it’s that you took on the debt to purchase is great debt.

Poor Debt: Any debt in which the price of the debt will amount to much more than the earnings are going to be created by whatever it’s that you took on the debt to purchase is actually bad debt, more at Consolidate Credit Card Debt USA

Getting The Car Loan That Suits You.

Every automobile is a lot more than a four wheeled automobile. It is owner’s glory, enthusiasm along with a supply of great admiration. Indeed, an automobile is not simply a way of transportation. It is America’s satisfaction and the ultimate ecstasy of its.

When someone sets out to purchase an automobile, some issues are being considered. Most people have a concept of what automobile to buy. Nevertheless, there’s dilemma and confusion whenever the topic of a car loan comes up. This specific write-up is going to give you a comprehensive understanding of the countless car financing options offered along with you. Lear more about your next car loan

What Does It Cost To Hire A Lawyer

Most lawyers don’t put their legal fees online. The main reason they do not is because generally each case differs and there might be a fluctuation in prices between clients. Nevertheless, you ought to have a kick off point for a lawyers cost. Most lawyer cost is largely driven by experience of the quantity and also the lawyer of training the lawyer has had in law. The are a few more reasons cost may fluctuate between lawyers such as for instance the overhead of the lawyer.

Most lawyers don’t put their legal fees online. The main reason they do not is because generally each case differs and there might be a fluctuation in prices between clients. Nevertheless, you ought to have a kick off point for a lawyers cost. Most lawyer cost is largely driven by experience of the quantity and also the lawyer of training the lawyer has had in law. The are a few more reasons cost may fluctuate between lawyers such as for instance the overhead of the lawyer.

You Need A Good Home Budget To Survive

The web is a saturated jungle of household budget program which range from the basic, to the really complicated in functionally. To effectively navigate this maze of marketing mayhem, as well as go walking away with the correct Home budget software program or maybe budget spreadsheet; you are going to need to have along with you, in the background of the mind of yours as the search of yours, those crucial key components which are essential in making your family’s house hold debt-free dreams come real! Key elements like user-friendly interfaces, graphics and text with information that is useful, and comfortable supplemental add-ons.

The web is a saturated jungle of household budget program which range from the basic, to the really complicated in functionally. To effectively navigate this maze of marketing mayhem, as well as go walking away with the correct Home budget software program or maybe budget spreadsheet; you are going to need to have along with you, in the background of the mind of yours as the search of yours, those crucial key components which are essential in making your family’s house hold debt-free dreams come real! Key elements like user-friendly interfaces, graphics and text with information that is useful, and comfortable supplemental add-ons.

Finding The Best Debt Solutions In Canada

Perhaps you must take out an extra loan to cover the original automobile loan. If you’re unable to acquire a credit score card consolidation loan, do not eliminate hope all together. To steer clear of declines it’s important that you locate a remedy to fix your credit score. If your credit is good enough you could find a loan the size that you require, it might be beneficial that you pursue debt consolidation. To get favorable provisions, you frequently have to have good credit. You may also cut up some or all your credit and store cards.

Perhaps you must take out an extra loan to cover the original automobile loan. If you’re unable to acquire a credit score card consolidation loan, do not eliminate hope all together. To steer clear of declines it’s important that you locate a remedy to fix your credit score. If your credit is good enough you could find a loan the size that you require, it might be beneficial that you pursue debt consolidation. To get favorable provisions, you frequently have to have good credit. You may also cut up some or all your credit and store cards.

Your debt to credit limit ratio accounts for at least 30% of your score, therefore it becomes absolutely crucial to eliminate your debt first when you’re attempting to improve your credit rating. To do so, you have to modify the way that you view debt! Debt is among the simplest things to get into, but among the hardest to escape from. Charge card debt can be the 1 thing that could easily set you into jeopardy, and you might discover that if you’re not extremely cautious you will realize that the pattern can be simple to repeat. Many in Kelowna are turning to