Learning debt management is an essential element of making the cash work of yours for you. An excellent place in order to begin on the road of yours to Financial Freedom is actually learning debt management as well as to start you’ve to learn the big difference in between bad debt and good debt. First allow me to provide you with a lot of definitions:

Learning debt management is an essential element of making the cash work of yours for you. An excellent place in order to begin on the road of yours to Financial Freedom is actually learning debt management as well as to start you’ve to learn the big difference in between bad debt and good debt. First allow me to provide you with a lot of definitions:

Debt that is good: Any debt in which the price of the debt is going to be surpassed by the earnings are actually created by whatever it’s that you took on the debt to purchase is great debt.

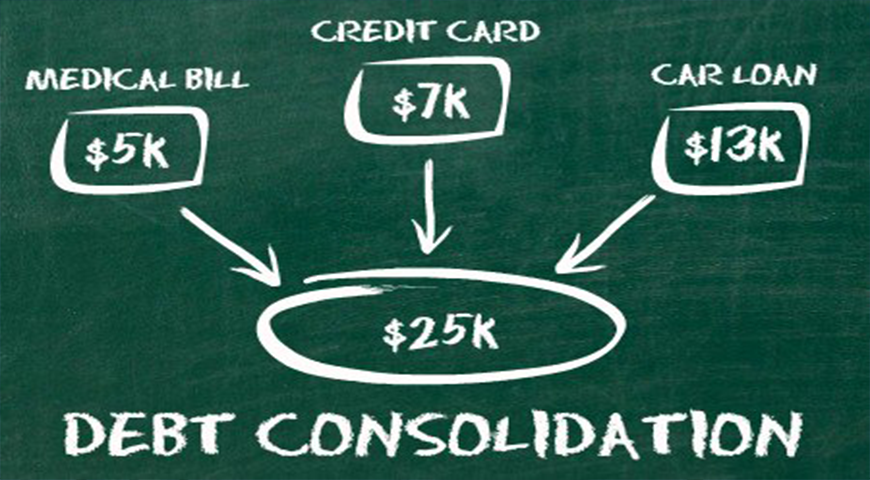

Poor Debt: Any debt in which the price of the debt will amount to much more than the earnings are going to be created by whatever it’s that you took on the debt to purchase is actually bad debt, more at Consolidate Credit Card Debt USA

It is that simple. When you’re looking into taking on debt don’t merely be mesmerized by whatever it’s that caught the eye of yours. Debt management mandates you’ve to run the numbers. Indeed, you are able to finance that automobile and drive it off of the lot at this time, but could it be worthwhile to spend $40,000 for a $19,000 automobile? Even in case you’ve to work with your previous $5,000 as a down payment? If the answer of yours is sure next there’s no help for you. You’re incapable of debt control. Stop reading these days. For those with the good sense to say “No” to the above mentioned question I’m going to provide you with a jewel which was provided to me by several of the very best to actually do it. This particular jewel was dropped on me while I was 16 years of age. I was informed that debt management is actually crucial to accumulating wealth and that anyone that knows anything about debt control would never actually think about placing $10,000 down on a $100,000 dollar automobile.

That might be counterproductive. A genuine hustler would utilize a $10,000 dollar automobile to make $100,000. That’s debt control. I was informed that the crucial to debt management isn’t to stay away from debt completely. The crucial to debt management is knowing how you can make use of debt to the benefit of yours. I’ve never forgotten this piece of wisdom and it’s a jewel that may be put on to every element of the monetary decision of ours making process. The distinction between bad debt and good debt is the fact that great debt will pay for itself and set more cash in the pocket of yours while poor debt is actually money owed for an unwanted merchandise you could not pay for. Management yourselves individuals. At this point it’s time for another definition:

Required Debt: Any debt which is crucial in order to possibly the running of the business of yours or even to taking proper care of your business is recommend debt.

Instances of required debt consist of such things as an automobile, a home, credit cards, pupil loans, and other recurring company associated expenses that you might have. The essential thing to comprehend about required debt is the fact that it is able to be either terrible debt or very good debt based on the conditions. This’s vital. As a result of the point that I realize that the majority of financial advisors place the products which I outlined in either the great debt or maybe poor debt categories, I’m going to explain the reason why I call the above mentioned expenditures needed debt.

The Mortgage: The American Dream has turned into the American Nightmare. Unless you’ve been living in a rock you understand this once all American buy is currently under serious scrutiny. Many people are led to think that the house of theirs is regarded as the costly buy which they’ll actually make in the daily life of theirs. This’s not necessarily accurate. In certain situations it is going to be your mortgage loan which is probably the most costly buy which you’ll actually make in the daily life of yours. It’s very common to see the expense of buying the loan (the interest) amount to much more than the concept of the loan itself. You wind up having to pay the bank $160,000 to loan you $150,000. Therefore in case you hold onto the home for the life of the loan you wind up having to pay $310,000 for a $150,000 dollar home. I know what you’re thinking, that the valuation of the home is going to appreciate in time thereby offsetting the interest costs on the loan.

That’s what you are thinking right? Right? Effectively which would rely on the property which you’re getting, but judging by the millions of Americans who sometimes lost the homes of theirs to foreclosure or perhaps are actually underwater on the mortgages of theirs I believe its safe to state that the appreciation of a property can not make up for a terrible deal. When you are able to get a great deal on the home in you get it at a price tag in which the money of yours is created whenever you purchase, the mortgage which you are taking out on that home may be looked at debt that is good. While I say the money of yours is created whenever you purchase what I’m saying is you receive the property at such a low cost that still in case the great does not appreciate you’d nonetheless turn an income if you are selling. This’s the sole time that a mortgage could be looked at debt that is good. In case you would like a home only since you’re currently holding on to a fantasy that America woke up from a lot of moons ago then that’s the decision of yours to make. Simply realize that in case you don’t receive the deal type that I discussed above then you’re taking on a terrible debt. This’s viewed as an essential debt since you’ve to invest a little money type on a roof over the mind of yours, nevertheless, you are able to constantly lease or even lease till you are able to discover a deal which may be worth locking yourself in to for the next thirty years.